In quarter one of 2021, Google, Temasek, Bain & Company forecasted Vietnam’s booming e-commerce sector would reach $52 billion in revenue by 2025. Throughout the year-long battle against COVID-19, things are still looking notably steady on the track towards that estimation. Customers are spending more time at home and even more cash online.

There have been significant variations in consumer behaviour, however, with notable differences in spending across platforms and categories, according to the latest report by global data and analytics company YouGov, who believes there isn’t a better time than now for businesses to invest in their e-commerce strategies and online campaigns. With social distancing accelerating the trend toward cashless transactions, companies may be looking at huge opportunities in the e-wallet space.

Amidst Vietnam’s current fourth wave, in order to best respond to new customer demands, brands can take a lesson in how the pandemic has changed consumer behavior.

Surging consumer spending

E-commerce outperforms traditional brick-and-mortar retail during COVID-19 in Vietnam with a modest spending spike. YouGov’s data shows that almost half of consumers (43%) spent less in stores during previous waves of the outbreak, compared to around a third (36%) who spent less online.

As lockdowns forced stores to close and people to spend more time at home, around a third (32%) of consumers turned to online splurging. This is because customers prefer to have goods delivered to their doorstep, rather than going outside and risking infection.

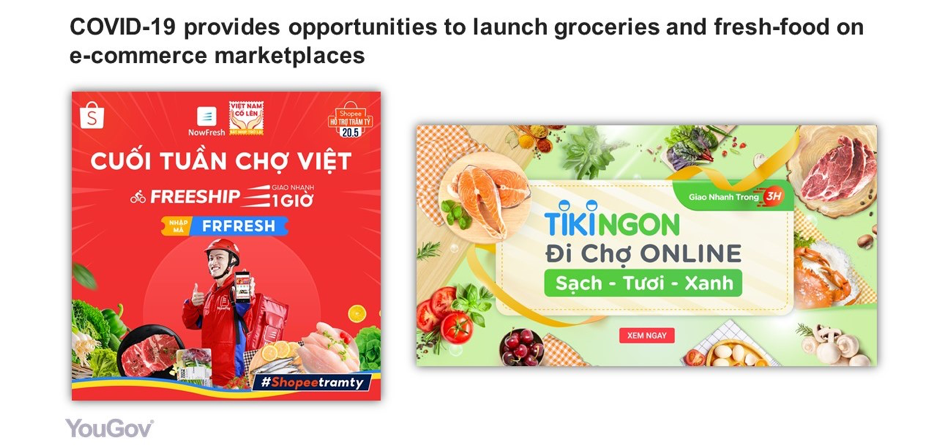

But this trend is not consistent across the board. The fastest-growing segment was groceries, with other items such as appliances and electrical goods seeing a fall in sales. Therefore, it would be more ideal during this new wave for brands to launch promotions for fresh food and halt marketing campaigns for other non-essential goods.

Mobile is the way to go

In a country where over 93% of the adult population owns smartphones, any brand who wants to truly connect with consumers needs to optimize their offerings for mobile. Smartphones are the most popular device for going online, with two-thirds of people (66%) accessing the internet on their handset, making mobile consumers an attractive audience for online retailers.

Furthermore, COVID-19 has made cashless transactions more popular with consumers, opening up huge opportunities for e-wallet platforms. Before the pandemic, nearly 90% of Vietnamese customers said they prefer cash-on-delivery payment when ordering online. Now, more than half of participants (51%) report using cash less often, and almost two-thirds (60%) feel more confident about doing without it altogether.

This is a positive sign of accelerated growth in demands for e-wallets, even after the pandemic has been brought under control.

Urban versus rural: One size doesn’t fit all

Effective marketing is when brands can approach their campaigns with in-depth knowledge of consumers and their online preferences. Here in Vietnam, that means recognizing the urban nature of online retail, when three-quarters (74%) of new customers come from towns and cities, where the most popular e-commerce platforms are marketplaces such as Shopee, Lazada and Tiki.

These companies combined take up a huge slice of the total market share, with close to half of all consumers using Shopee (48%), almost one third (28%) using Lazada and around one fifth (19%) using Tiki.

On the other hand, brands looking to target consumers in rural areas should redirect their marketing budget in the direction of social commerce. Using social media sites to buy and sell products is more popular outside of major cities: while 13% of people in urban areas engage with e-commerce through Facebook, the number is 18% in rural regions. As a result, online marketplaces are less popular with rural consumers, although they still dominate the overall e-commerce space.

“To grab these new opportunities, brands need to use data-rich insights to optimize their future outreach; to ensure that their campaigns speak to consumers and respond to their needs,” commented YouGov Vietnam CEO Thue Quist Thomasen.

“This requires platforms that track fast-moving consumer behaviour, and tools which give in-depth insights into the Vietnamese consumer, their attitudes and spending habits.”