How do you choose your bank?

Some go for the one that’s everywhere — their mindset is if they’re everywhere, then they’re big and if they’re big, they’re trustworthy. So then, “my money is safe with them”. Others go for convenience, that bank that comes with a responsive and user-friendly app that its users can access anytime, any day, even on holidays. And there are those who just don’t care and go with that bank their employers partner with.

Months under strict social distancing measures and not being able to go out to withdraw and do in-bank transactions, having a decent amount of cash on hand is extremely rare — credit and debit cards have been everyone’s savior in the past months.

According to various international reports on digital banking in the Asia-Pacific, Southeast Asia and India are considered "promised land” for digital banks. In fact, the potential has significantly increased since digital adoption has grown rapidly in recent years, with the region now home to a digitally connected population of over 400 million, and it’s likely to grow substantially in the coming years with the new advances in coverage.

Finance magazine recently reported that with Vietnam’s young population, technology and internet accessibility are high, and the percentage of the population using smartphones is increasing rapidly — an opportunity digital finance institutions should never miss.

However, experts say digital banks must overcome many barriers to be recognized as traditional landers in the next 10 years. Speeding up regulatory approvals for digital banks is also important.

In the same way, the banks themselves need to have long-term plans and the vision to invest in technology, regular improvement, maintenance, and systems to enhance their competitiveness to be able to keep up with the digital changes.

In a country with the lowest population rate served by banks in the region, just over 40, the habit of paying in cash is still the common practice.

YouGov conducts the biggest-ever consumer finance survey

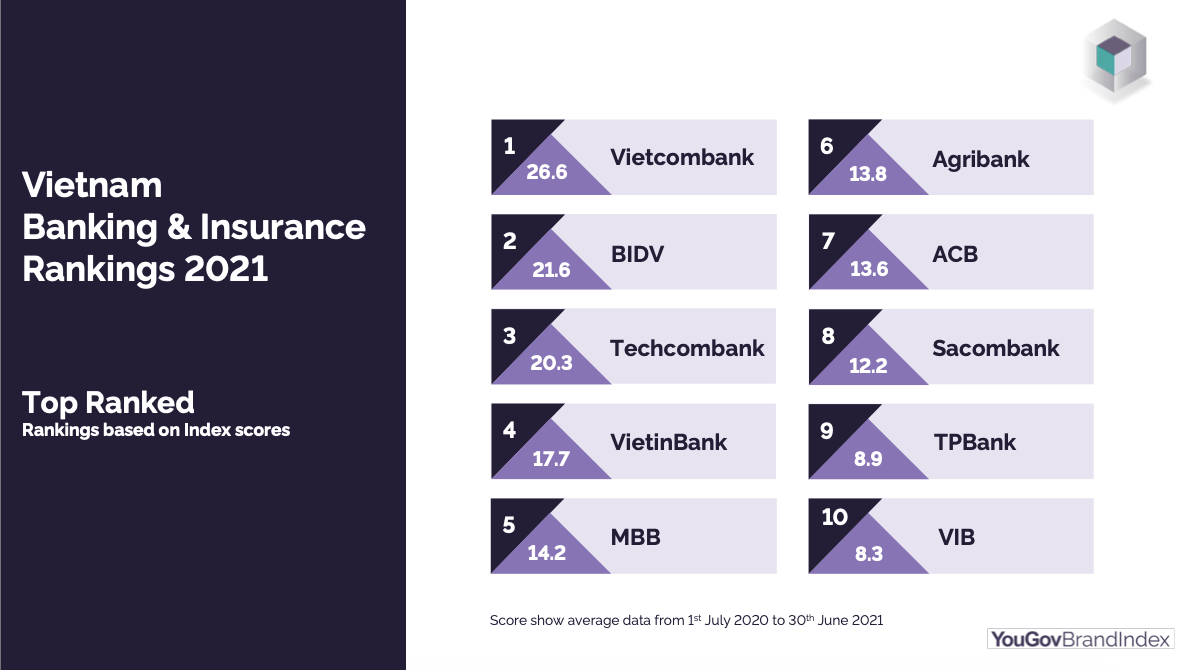

YouGov’s first Banking & Insurance rankings, with over 45,222 participants, reveal Vietnam’s strongest and most recommended banks in the country.

Between July 2020 and July 2021, consumers believe Vietcombank is the strongest financial brand, with a score of 26.6. BIDV came in second and Techcombank in third, with 21.6 and 20.3 respectively.

The scores are based on an aggregate of six unique criteria measuring consumer perceptions of local and international financial institutions in the country. Banks and insurers were rated on their reputation, customer satisfaction, value-for-money, quality, overall impression, and whether people would recommend it to others.

In the same ranking, changing trends in consumer attitudes towards banks and insurers were also measured as well as tracking which financial brands have improved over time.

Vietcombank ranked first with a rise of 6.2 points when comparing scores from the previous 12-month period. Techcombank was the second-most improved institution with 4.7 points, and VietinBank came in third after recording a 3.3 point increase.

YouGov Vietnam CEO Thue Quist Thomasen said, “For the first time, these rankings reveal the financial brands that consumers trust, value, and recommend. Our data shows that local banks have the strongest brands for Vietnamese consumers. However, foreign institutions dominate the insurance market. This poses a challenge to local banks looking to grow their customer base in this area”.

Like in any other sector, one of the most important individual measures of future growth in the banking and insurance sector is the likelihood that customers would recommend an institution to their friends and families. Here, data revealed that Techcombank is the most trusted bank with a ‘Recommend’ score of 81.2. MBB (74.6) and TPBank (74.4) came in as the second and third ‘most recommended’ respectively.

As for the foreign banks, it looks like they’re gaining ground in the minds of Vietnamese consumers as well. HSBC and Citibank both appear in the top-ten ‘most recommended’ while Citibank is also the third-biggest improver, according to the survey.

Unsurprisingly, foreign firms have a much stronger presence in the insurance sector. While BaoViet Life takes the gold medal, insurers from Canada, the US, Hong Kong, Japan, Italy, Switzerland, Taiwan, and the UK take up eight of the top ten places.

Thue Quist Thomasen also shared that building a strong brand is one of the most important factors in creating a successful company in Vietnam. To do this, brands must sustain a competitive advantage, and achieve a high valuation.

“Our data can give financial institutions unique insights into how customers rate their brands and services, which banks can use to optimize their marketing campaigns and gain greater market share,” he concluded.