As most financial experts and analysts have highlighted since last year, the coronavirus pandemic has greatly impacted consumers’ spending habits, and accelerated the shift to e-commerce.

Mastercard New Payments Index, a study conducted by the global payment technology pioneer, found out that 94% of people in the Asia Pacific region are considering the use of at least one emerging payment method, such as QR codes, digital or mobile wallets, installment plans, cryptocurrencies and biometrics. Of this, 84% said they already have access to more ways to pay compared to a year ago, and 74% said they would shop at small businesses with greater frequency if they offered additional payment options.

“Mastercard’s study finds that people in the Asia Pacific region haven’t just adopted new payment technologies — they’ve made deliberate shifts based partly on necessity, but also on considerations around personal safety, security and convenience, at a time when these concerns were paramount,” said Sandeep Malhotra, Executive Vice President, Products & Innovation, Asia Pacific at Mastercard.

“Consumers in Asia Pacific have already gained recognition globally for their openness to new technologies and innovation, and these findings confirm that this trend is only set to continue as more digital payment options rapidly become mainstream in this part of the world.”

QR codes have especially gained popularity, a roaring comeback so to speak. The old-school tech, made of a pattern of squares arranged on a grid, was invented in the 90’s by the Japanese, was used by marketers years ago as a quick way to direct people to online destinations.

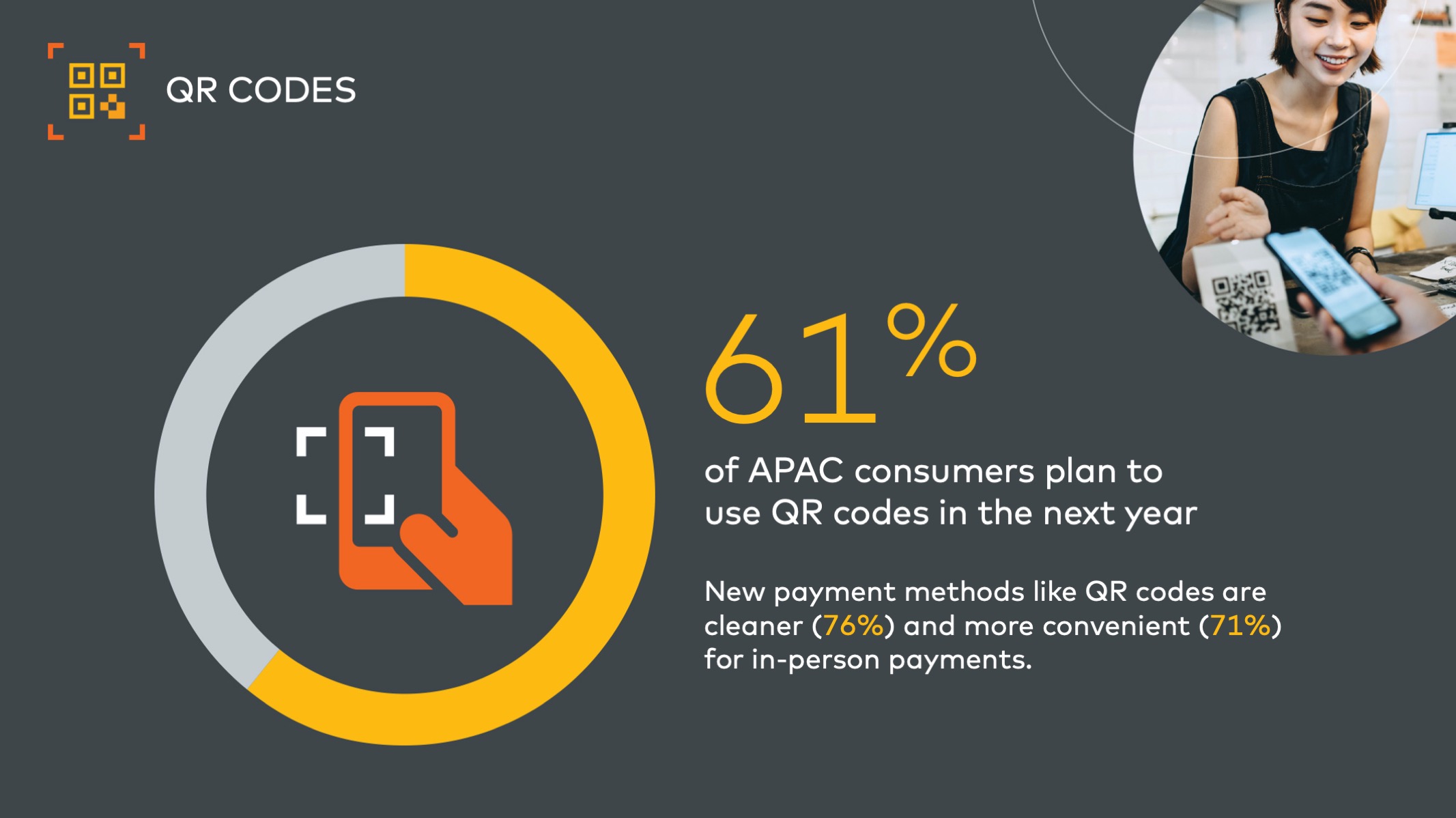

Of those who used QR codes for payment, 63% said they used them more frequently in the last year than they had in the past. In both Thailand and India, the number is 64%, above the global average of 56%. A huge percentage (61%) also said they plan to use QR codes next year, as many perceive it as cleaner (76%) and more convenient (71%) for in-person payments as it is likely consumers are using their own mobile device.

There is greater trust in QR codes now, according to Mastercard, a significant mindset shift from years ago when reports of disappointing consumer experience were widespread.

Other emerging payment methods

Besides QR codes, cryptocurrencies and digital wallets are also gaining ground, thanks to millennial consumers who are increasingly showing interest in being able to spend crypto assets for everyday purchases. Forty-five percent of those surveyed in APAC said they are likely to consider using cryptocurrency in the next year, higher than the global average of 40%.

Millennials and centennials are relatively more comfortable using cryptocurrency (41%) compared to Gen X and Boomers (26%), with 71% of millennials saying they are more open to using it now than they were a year ago. Geographically, more consumers in Thailand (46%) and India (44%) are comfortable using cryptocurrency as compared to consumers in Australia (17%). While consumer interest in cryptocurrency — especially floating digital currencies such as Bitcoin — is high, work is still required to ensure consumer choice, protection, and their regulatory compliance as a payment instrument.

This trend of using payment technologies will only go upwards from here, according to Mastercard, as people’s comfort with and understanding of these new and modern payment methods increases. The use of cash will eventually decrease, with 69% of respondents in the region said they plan to use cash less frequently.

“This behavior shift is reinforced by people’s desire for choice — with 85% of consumers in APAC saying that they expect to make purchases when they want and how they want. Businesses that can provide multiple ways to shop and pay will be best positioned to meet the unique needs of this moment that are shaping the future of commerce for years to come,” added Malhotra.

Along with this rising trend comes increasing security concerns. With one in four respondents in APAC (27%) reporting that they were victims of fraud last year, consumers need to be assured that the payment methods they are using are safe and would not compromise security. Seventy-nine percent indicated they would be open to trying new payment technologies if they perceived them to be safe, while 85% want to be sure the payment options the merchant offers are secure. As such, many consumers place trust in issuers and networks to provide tools that keep their financial information secure, with 45% agreeing that they would place their trust in their payment provider to follow security best practices, so they can be more hands-off. On the flip side, the top reasons given for not trying new payment methods include security concerns (47%) and data protection concerns (42%).

Businesses adapting to payment trends

With increasing consumer interest around new payment technologies, the expectation for businesses to adapt for the long-term is here to stay. What’s more, a recent study on 5,500 major Mastercard merchants showed that between Q1 2020 and Q1 2021, more than a fifth of these merchants globally increased the number of ways they connect with consumers, either by enabling an e-commerce channel or accepting contactless transactions.

Over the same period, Mastercard saw the total number of card-not-present transactions grow by over 30% globally while more than 100 markets saw contactless as a share of total in-person transactions grew by at least 50%.

In the first quarter of 2021 alone, Mastercard saw one billion more contactless transactions as compared to the same period of 2020, with particular momentum in India and Thailand where usage doubled and quadrupled respectively year-over-year.