Amid a sharp decline in venture capital poured into Vietnamese startups in the first half of 2023, Edtech and Healthtech remained among the most funded sectors, indicating a golden time for the education market in Vietnam.

MindX, a startup that provides web/blockchain programming coding, UX/UI, and project management training, has announced a $15 million Series B fundraising round from private equity firm Kaizenvest in April 2023. MindX’s mission is to build “little Silicon Valleys” across Vietnam by providing educational centers that help adults in Vietnam pursue their careers in tech. MindX deal was also marked as one of the largest amounts raised by Edtech in Vietnam by the end of H1 this year.

In April 2023, Prep Edu, a Hanoi-based startup specializing in online courses and test prep, secured $1 million in funding from East Venture and Cercano Management in their seed round.

Targeting the Kid and Teen segments, Teky Alpha (established in 2016), an education startup that offers science, technology, engineering, the arts, and mathematics (STEAM) sessions for students aged 6–18, successfully raised $5 million from Singapore-based investment firm SweefCapital in May 2023 to expand its education coverage.

In the K12 segment, Vuihoc, an online learning platform that provides interactive classrooms to over 1 million students, also closed $6 million in series A funding.

The success stories of MindX, Teky, Vuihoc, Edupia, Prep, Equest, etc., are a good signal that EdTech in Vietnam is still attracting foreign solid capital from private equity and venture capital amidst the winter funding for tech startups. A new wave of investment in education startups can be observed with a focus on STEAM for all ages. Edtech can expect a breakthrough in Vietnam in the next five years.

According to Statista, revenue from online education in Vietnam is projected to reach 328.2 million USD in 2023. Revenue is expected to show an annual growth rate (CAGR 2023–2027) of 10.4%, resulting in a projected market volume of 487.57 million USD by 2027.

Medtech is becoming a high-potential sector

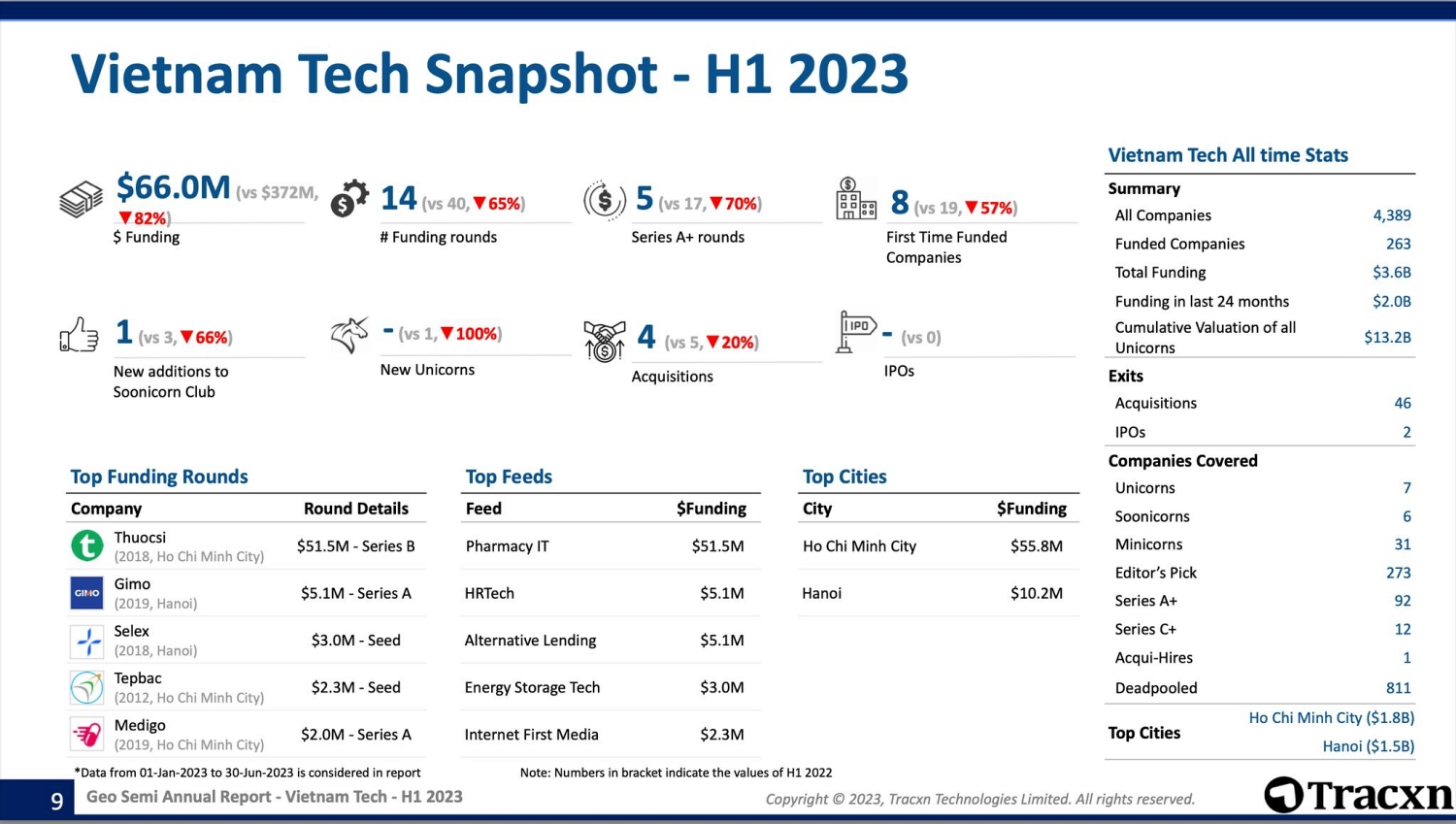

Despite the winter funding period, data from Tracxn Technologies shows that startups in the medtech sector have raised $53.5 million, a record amount up 118% from the first half of 2022.

BuyMed, the firm behind thuocsi.vn was a highlight in health tech when it closed a $51.5 million series B fundraise led by UOB Venture Management (UOBVM), with participation from the United States International Development Finance Corporation (DFC), Smilegate Investment, and Cocoon Capital. BuyMed (founded in 2018) is a Vietnamese online pharmaceutical marketplace providing pharmacies with healthcare products and medications. Targeting the B2B2P business model, BuyMed’s mission is to simplify healthcare distribution in Vietnam and Southeast Asia.

Besides BuyMed, Medigo (established in 2019), a telehealth startup that provides on-demand medicine prescription and delivery services, has disclosed $2 million in a series A funding round led by East Ventures with the participation of Pavillon Capital and Touchstone Partners. With its unique selling point of offering convenient, fast, and cost-saving health services, the Medigo mobile app has more than 500K active users and nearly 1,000 pharmacy partners across Vietnam.

Healthtech and Medtech in Vietnam are becoming promising yet challenging sectors since the market is still fragmented and needs education and the adoption of digital health services. Despite the difficulties of the strict legal framework and the readiness of back-end systems and infrastructure, healthcare, and education are expected to remain investment magnets.